NYX

Love the NYSE Brand, but Short the Stock. This article was originally posted on the Street Insight section of thestreet.com 3/14/2006 8:26 AM EST.

I am bearish on the NYSE Group, owners of the New York Stock Exchange (NYX). The NYX shares an effective duopoly in U.S. stock exchanges along with the Nasdaq (NADQ), and the NYX has a market cap of $12 billion.

I believe the NYSE Group is an excellent short play on a firm that is part of the indispensable infrastructure of capital markets. The stock is overvalued, and a secondary offering is forthcoming, as I detail below. I also believe that management is overreaching with the recent reports that the NYX may make a counterbid for the London Stock Exchange.

Motivations of Shareholders/Seat Holders

NYSE seat holders got 80,177 shares of NYSE Group stock, according to SEC documents (form 8-K dated March 7, 2006). They also got $300,000 in cash and $70,571 in dividends. The key factor is this: seat holders will be able to sell up to one-third of their stock in a secondary offering scheduled for April or May. So seat holders have a large stake in NYX and they will be able to sell soon. These same seat holders control the trading of the NYX on the stock exchange. So if you think this particular set of owners will fail to maximize the value of their holdings by selling now, especially when they have one chance to get out, then you haven't been paying attention to the market scandals of the past five years. These owners will use every (borderline legal)trick in the book to quickly exit positions they have owned for years. I believe NYX can fall by 50% or more over the next one to two months with minimal upside risk.

Technology Boosts Market Efficiency

I have been saying for some time (to the SEC, at least) that public companies will soon conduct board elections over the Internet. Candidates will be nominated by shareholders online and a fair, efficient candidate screening and election procedure will be established. Likewise, I think firms will soon begin using Dutchauction style systems to allocate and price initial public offerings. In fact Brinks (BCO) will offer 10 million shares via Dutch Auction. An Internet based, online system, allowing for the dissemination of corporate governance data, pricing information and securities, will significantly lower the cost of raising capital. I believe this lowered cost will result in more companies coming to market. More companies coming to market will result in, other things equal, higher levels of economic activity, lower unemployment and lower inflation.

Unfortunately, while greater efficiency is good for America, it is not in the interest of the NYSE, which acts as a middleman.

Just because this will happen doesn't mean it will happen tomorrow. In the meantime, market infrastructure players will do well. This includes the collection of brokers, market exchanges and credit rating organizations.

Jim Cramer likes Nasdaq's (NDAQ) bid for the London Stock Exchange, as he noted last week. And I agree with Jim when he says NYX is a cult stock. This supports my short position: cult status, price out of line with fundamentals. Sounds like a new tulip mania to me.

Chicago Mercantile (CME) and CBOT (BOT) also need to find a way to grow. Over the longer term, I want to own the group. They are likely to be cleaner, free from market manipulation worries that will follow NYX. I believe that NYX is an excellent long-term play on financial market infrastructure. Why? Because monopoly franchise positions are very, very valuable. Just ask the person who owns the McDonald's (MCD) franchise in Times Square. I was there a week ago at 11 p.m. on a weeknight. The place was packed. Just as this franchise is valuable, so is the franchise that the NYX controls.

The company has high growth in revenue and earnings, and controls a business with very high barriers to competition. I just don't like it at $85.00 a share in a market where they are looking to buy anther exchange and additional, significant supply is forthcoming.

Brokerage Stocks Are Booming

Brokerage firms, specifically, are doing spectacularly well, and every indicator suggests they will continue to do so. As Matthew Goldstein recently noted on RealMoney, "brokerage stocks are up 242% since bottoming in October 2002, as measured by the Amex Broker Dealer Index. Over that time, the S&P 500 is up 64%, while the Dow Jones Industrial Average has risen 48%." And keep in mind that brokerage firms are showing outstanding performance when they have been shown to be, well, less than honest and subsequently hit with record fines. (Given a 242% return, perhaps the fines were not big enough.) But, after the run-up they've experienced, I don't want to own brokers, unless it is as a short. I prefer to own other market infrastructure players.

The New York Stock Exchange, in 2006, bought electronic communications network (ECN) Archipelago to support a move into automated trading (and to bolster its duopoly position, alongside Nasdaq, as the most powerful stock exchanges in the world.) The stock started trading to the public last Wednesday (March 8) morning at $67. Two days later, shares were trading at $85. I would use this initial spurt to set up shorts.

Valuation

This short idea is based on a few specific catalysts: The upcoming secondary offering, the company's track record for stock price manipulation, its incentive to do so, and the cult status of the stock (fundamentals detached from price). I think the stock will continue to do well until then as seat holders, broker/dealers, and other member firms support the stock. But the NYX is headed for a big bump in the road after the offering.

The stock closed on Monday at just about $81. Let NYX have its day in the sun. But the stock is due for a fall. A big one. I would short at the end of this month in anticipation of the secondary offering. The idea will play out over the next thirty days.

After this, over the next three to twelve months, I'm bullish. Since NYX eliminated Archipelago as a threat by purchasing it, the only real competitors to NYX are now other exchanges. This includes the NASDAQ (NDAQ), the Chicago Mercantile Exchange (CME) and the Chicago Board of Options Exchange (CBOT), all of which have similar monopoly/oligopoly status. (Look for a mega merger at some point.) So after the stock takes a hit next month I'll be back for another look.

Stock Performance

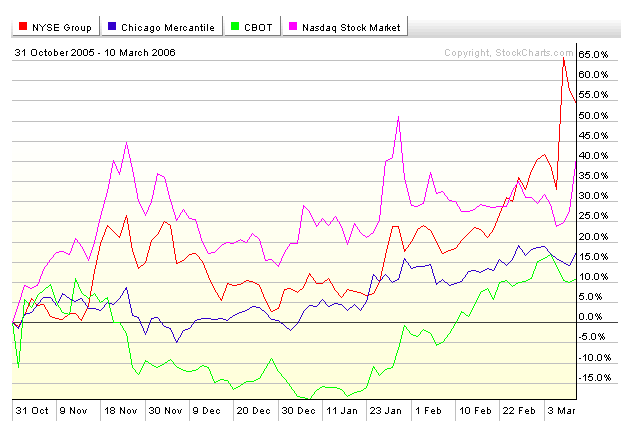

Here is a chart showing how, over the past ninety days, NYSE Group stacks up versus the Nasdaq, CBOT, and CME:

Source: StockCharts.com

While the NYSE Group shows up on the chart, the public was actually not able to buy shares until March 8, 2006, so the chart is a little deceiving.

Price Target and Stop Loss

This short idea is more about time than it is about price. This short idea will expire a few weeks after the secondary offering, when the support of member firms and seat holders begins to dissipate. I think that the shares could easily drop back to $60 once this support is gone. Even at $60 the stock's P/E is about 65x trailing EPS. (Forecast data are hard to come by since the stock is now in the "quiet period.") A P/E over 60x is high even for an oligopoly. Return on equity and on assets are about 15% and 11% respectively, so investors are paying for future growth, not for a lucrative franchise. Granted, maybe the cost structure of the firm is going to change as a public company. Unfortunately, being public generally adds costs.

I have a hard stop at $90, about $10 above the recent close. So the stock offers a reward-to-risk ratio of about 3 to 1, which is not bad. Especially if it plays out in a matter of weeks, as I expect it will.

No positions